Shopify Inc. Fundamental Analysis

Disclaimer: This article by The Globetrotting Investor is general in nature. We aim to bring you long-term focused analysis driven by fundamental data, hence, providing you commentary based on historical data and analyst forecasts only using an unbiased methodology. This is not a buy/ sell recommendation, and it is solely for educational purposes. Please do your research before investing. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Please read the full disclaimer here.

Shopify Inc.

Last Updated: 27 May 2023

NYSE: SHOP

GICS Sector: Technology

Sub-Industry: Software — Application

Table of Contents

You can download a summary of Shopify Inc.'s fundamental analysis in PDF here.

Management

CEO: Tobi Lütke

Tenure: 18.7yrs

Shopify Inc's management team has an average tenure of 2.0 years. It is considered inexperienced.

Source of Revenue

Shopify is a provider of essential internet infrastructure for commerce, offering tools to start, grow, market, and manage a retail business of any size.

In an era where social media, cloud computing, mobile devices, augmented reality and data analytics are creating new possibilities for commerce, Shopify provides differentiated value by offering merchants:

-

A multi-channel front end. Its software enables merchants to display, manage, market and sell their products across over a dozen different sales channels, including web and mobile storefronts, physical retail locations, pop-up shops, B2B, social media storefronts, native mobile apps, buy buttons and marketplaces. The Shopify application program interface ("API") has been developed to support custom storefronts that let merchants sell anywhere, in any language.

-

A single integrated back end. Its software provides one single integrated back end that merchants use to manage their business and buyers across these multiple sales channels.

Shopify also enables merchants to build their brand, leverage mobile technology, sell internationally, and handle massive traffic spikes with flexible infrastructure:

-

Brand ownership. Shopify is designed to help its merchants own their brand, develop a direct relationship with their buyers, and make their buying experience memorable and distinctive.

-

Mobile. As transactions over mobile devices represent the majority of transactions across online stores powered by Shopify, the mobile experience is a merchant’s primary and most important interaction with online buyers. Shopify has focused on enabling mobile commerce, and the Shopify platform includes a mobile-optimised checkout system, designed to enable merchants’ buyers to purchase products more easily over mobile websites.

-

Global. Shopify offers merchants across several countries a localised experience within the country in which they are based. In addition, Shopify Markets, enables merchants to manage localised storefronts in different countries through one global store, making cross-border commerce easier for entrepreneurs. Shopify Markets Pro, introduced in 2022, offers merchants a native merchant-of-record tax and duty compliance solution.

The enterprise-level functionality allows merchants to start with a Shopify store and grow with the platform to almost any size. The Shopify Plus subscription plan was created to accommodate larger merchants, with additional functionality, scalability and support requirements. The Shopify Plus plan also appeals to larger merchants not already on Shopify who want to migrate from their expensive and complex legacy solutions to achieve greater functionality and flexibility.

Shopify has two revenue streams: a recurring subscription component called subscription solutions, and a merchant success-based component called merchant solutions.

Subscription Solutions

Shopify generates subscription solutions revenues primarily through the sale of subscriptions to its platform, including variable platform fees, as well as through the sale of subscriptions to its POS Pro offering, the sale of themes, the sale of apps, and the registration of domain names.

Merchant Solutions

Shopify offers a variety of merchant solutions to augment those provided through a subscription to address the broad array of functionality merchants commonly require, including accepting payments, shipping and fulfilment, and securing working capital.

The company principally generates merchant solutions revenues from payment processing fees and currency conversion fees from Shopify Payments, transaction fees, referral fees from partners, advertising revenue on the Shopify App Store, Shopify Capital, Shop Pay Installments, Shopify Balance, Shopify Shipping, service fees from Shopify Fulfillment Network including Deliverr, Inc. ("Deliverr"), 6 River Systems sales, non-cash consideration obtained for services rendered as part of strategic partnerships, the sale of POS hardware, Shopify Email and Shopify Markets.

The success of Shopify's business model relies on several key factors. These include attracting new merchants, retaining revenue from existing merchants, and increasing sales for both new and existing merchants. To achieve this, Shopify aims to expand its merchant base, customise features for different geographical markets, retain merchants as they expand their businesses and utilise more platform features, offer additional sales channels to connect merchants with their target audience, develop new solutions to enhance platform functionality and drive merchant sales growth, improve their ecosystem and partner programs, provide excellent merchant support, recruit and retain qualified personnel, and prioritise long-term value in their strategies.

Shopify Inc. Revenue Geographic Breakdown FY2022

Shopify Inc. Reportable Segment Revenue FY2022

Shopify Inc. Economic Moat

Shopify Inc. Economic Moat

Economic Moat: Narrow

There are many ways to identify Shopify Inc.’s economic moat, but I focus on the above 5 types. The rating is purely subjective and based on my in-depth understanding and analysis of Shopify Inc.. Please check my summary to understand more about the economic moat.

Performance Checklist

Is Shopify Inc.’s revenue growing YoY for the past 5 years consistently? Yes.

Is the net income growing YoY for the past 5 years consistently? No.

Is the cash flow from operating activities growing YoY for the past 5 years consistently? No.

Is the free cash flow positive for the past 5 years? No.

Is the gross margin % consistent/ growing for the past 5 years? No.

Is the EPS growing for the past 5 years? No.

Shopify Inc. Revenue, Net Income, Operating Cash Flow, and FCF (USD Million)

Is the free cash flow per share growing for the past 5 years? No.

Shopify Inc. FCF per Share

Management Effectiveness

Is Shopify Inc.’s ROE consistently at 12%-15% YoY for the past 5 years? No. Shopify Inc has a negative ROE as it is currently unprofitable.

Is the ROIC consistently at 12%-15% YoY for the past 5 years? No. Shopify Inc has a negative ROIC as it is currently unprofitable.

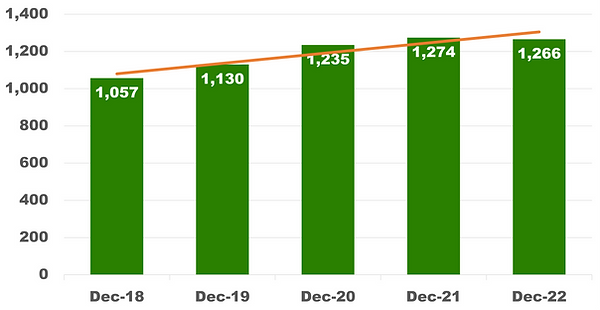

The trendline for the number of shares outstanding is increasing, which is something that an investor would not be pleased to see.

Shopify Inc. Shares Outstanding (Million Shares)

Shopify Inc. Financial Health

Shopify Inc. Financial Health (USD Million)

Current Ratio: 6.71 (pass my requirement of >1.0)

Debt-to-EBITA: -0.68 (fail my requirement of <3.0)

Interest Coverage: Shopify is unprofitable.

Debt Servicing Ratio: Shopify is unprofitable.

Dividend

Current Dividend yield: Shopify does not have a record of paying a dividend.

Shopify Inc. Intrinsic Valuation

Estimated intrinsic value: $8.01

Value is calculated using discounted cash flow method (taking into account their cash and debt) and scenario planning.

Free cash flow used: USD$300M

Projected growth rate: 8% - 15%

Beta: 2.0

Discount rate: 10.0%

Margin of safety: 50% (Uncertainty: Very High)

Price range after the margin of safety: <$4.00

Date of calculation: 27 May 2023

I used a higher estimate for free cash flow instead of a weighted average. If I use weighted average free cash flow, the estimated intrinsic value will be significantly lower.

Total debt and cash and short-term investments are last quarter figures that are rounded to the nearest tens. In some instances, I used more realistic numbers to represent them.

Shopify Inc. Intrinsic Valuation

Shopify Inc. Relative Valuation

Shopify Inc. Price-Sales Ratio vs its peers

Shopify Inc. Historical Price-Earnings Ratio

Additional Resources

I recommend reading University of Berkshire Hathaway as it greatly helps in my stock analysis. If you want a complete collection of recommended books, please visit here.

My Top Concern

Shopify Inc. earns revenue from subscriptions to its platform and additional solutions sold to merchants. However, there is a risk that merchants may not renew their subscriptions, which could affect the company's ability to retain them. The company has observed turnover among its merchants, particularly small and medium-sized businesses (SMBs), which are more vulnerable to economic conditions and other risks. Factors like the COVID-19 pandemic and general economic conditions can further impact merchant retention. The costs associated with subscription renewals are lower compared to acquiring new merchants or selling additional solutions. Failure to retain existing revenue or increase sales to existing merchants could harm the company's operating results.

Another concern is the impact of global economic conditions, including how it affects spending by merchants or their buyers, which may have adverse effects on Shopify's business. Economic downturns can decrease buyer confidence and spending, potentially leading to merchants going out of business or discontinuing the use of the company's services to conserve cash. Limited budgets and discretionary spending may also prompt SMBs to allocate their funds elsewhere, potentially affecting the company's platform usage. Weak economic conditions can also have a negative impact on the company's relationships with third parties.

Shopify faces competition from various rivals, and it expects this competition to increase in the future. Competitors may have advantages such as longer operating histories, larger customer bases, greater resources, and established relationships. They may develop superior products, respond more quickly to opportunities, or offer more attractive pricing. Niche companies that cater to specific merchant needs also pose competition. Competition may intensify through alliances, capital raises, or the entry of established companies from other market segments. Changes by major technology platforms like Apple and Google, which affect data access, can also impact the company's merchants and relationships. Ineffective competition could have negative impacts on the company's business.

Lastly, I am concerned about the storage of personal and confidential information of Shopify's merchants, partners, and consumers. While the company has implemented security measures, unauthorized access or breaches can occur, potentially having adverse effects on the business, reputation, and financial condition. The company must comply with cybersecurity laws and contractual requirements, and failure to do so could result in fines, penalties, and legal claims. Non-compliance could also lead to increased costs and damage to reputation. If credit card information is inadequately protected, the company could be held liable for losses, face regulatory action, and lose merchant relationships. Overall, data security and compliance are critical areas of concern for the company, with potentially significant consequences for non-compliance or security breaches.

Summary for Shopify Inc.

Shopify is an e-commerce platform that aims to provide a comprehensive solution for small retail businesses, especially those focused on online sales. The platform is known for its user-friendly interface, making it accessible to users with different levels of technical expertise. Furthermore, Shopify goes beyond basic e-commerce functionalities by offering a wide range of additional features. These features come together to create an all-in-one solution for small and midsize businesses (SMBs), enabling them to efficiently manage inventory, process payments, and customize their online stores. Recognizing the changing needs of the market, Shopify has expanded its offerings to include Shopify Plus, which caters to the advanced requirements of enterprises while maintaining the core benefits of the platform.

Since its initial public offering in 2015, Shopify has experienced remarkable growth in the e-commerce industry. This success can be attributed to several factors. Firstly, Shopify offers a diverse range of products and services that cater to businesses of all sizes and industries. This versatility allows Shopify to serve as a comprehensive e-commerce solution, going beyond its initial role as basic software for small businesses. By expanding its offerings and incorporating advanced features, Shopify has positioned itself as a one-stop platform for entrepreneurs and enterprises alike. This strategic shift has enabled Shopify to capture a larger market share and establish itself as a key player in the e-commerce landscape.

In terms of its business model, I would rate Shopify to have a narrow economic moat, primarily due to the presence of switching costs and the network effect. These factors contribute to strengthening Shopify's position and make it challenging for customers to switch to alternative platforms.

When businesses consider switching to a new software package, they face various challenges that influence these costs. A significant factor is the time and expense required to implement the new software while ensuring the smooth operation of the existing platform for customers. The transition process involves not only the technical aspects of migrating data and integrating systems but also the need for users to familiarize themselves with the new system. This learning curve can result in lost productivity as employees adapt to the new software and potentially disrupt the affected business functions. These indirect costs, both in terms of time and potential distractions, further enhance the switching costs associated with adopting a new software platform.

When considering the switch to new software, businesses also face various operational risks that contribute to the level of switching costs involved. These risks include the potential for data loss during the transition, challenges in executing the project successfully, and potential disruptions to ongoing operations. The magnitude of switching costs is influenced by factors such as the criticality of the function affected and the extent of the software vendor's involvement across different areas within an organization. In simple terms, the higher the importance of the function and the more interconnected the software vendor's presence, the greater the associated switching costs are likely to be.

In the case of Shopify, it serves as a robust digital commerce engine, providing customers with a comprehensive solution for their e-commerce needs. At the forefront, Shopify offers a user-friendly front-end interface that empowers merchants to effectively showcase and control their products across multiple channels. Additionally, Shopify provides an integrated back-end system that enables users to efficiently manage their e-commerce operations across these channels. This includes crucial functions such as sourcing, inventory management, order processing, payments, warehousing, fulfilment, and shipping. These elements are essential in executing successful sales strategies for customers and are considered mission-critical. This extensive involvement strengthens Shopify's competitive advantage by raising the switching costs for businesses looking to migrate to alternative solutions.

One of the positive aspects of Shopify is its wide range of clients, which contributes to its strength in the market. For small businesses operating in a business-to-consumer model, having a reliable digital commerce platform is essential. These small shops often lack an internal IT support function, making it unlikely for them to undertake the challenge of switching platforms.

Shopify offers a comprehensive solution that covers both internal operations and customer-facing aspects, catering to the specific needs of small businesses. Importantly, it allows merchants to maintain their own brand identity when selling on other marketplaces and build a significant customer data repository. This enables businesses to retain control over their brand image and customer relationships, fostering long-term loyalty. Furthermore, the larger segment of SMBs and enterprise clients that utilize Shopify's services benefit from a clearly defined moat based on switching costs. The established customer relationships in this segment tend to be long-term, with merchants opting for Shopify Plus, further solidifying their commitment to the platform.

Shopify's merchant solutions serve as valuable add-ons that complement its core subscription segment. These solutions naturally expand upon the core software offering, providing additional functionalities and features to merchants. The adoption of these solutions varies across countries and products, with Payments being the most widely embraced add-on. By offering these additional solutions, Shopify enhances the stickiness of its overall platform for SMB customers. The inclusion of these complementary features makes it more challenging for SMBs to switch to alternative e-commerce platforms, as they would not only lose access to the core functionality but also the value-added benefits provided by the merchant solutions.

The network effect is another significant moat source for Shopify. Similar to other software companies, Shopify has established an app store that offers additional functionalities to its users. While the revenue generated from the app store accounts for a small percentage of subscription revenue, it contributes to the overall ecosystem of the platform. With nearly 10,000 available apps by the end of 2022, Shopify has built a robust network of partners who actively refer potential customers to the platform.

Shopify Inc. has experienced consistent growth in revenue over the past five years, demonstrating its ability to generate increasing sales on a year-over-year basis. However, the company's net income has not displayed consistent growth during this period, and it recorded a significant loss of -$3.5 billion in the previous year. Similarly, the cash flow from operating activities has not shown a consistent upward trend over the past five years. Additionally, the free cash flow was -$186 million last year, indicating that the company has not been able to generate positive cash flow from its operations. Moreover, the gross margin percentage has not remained consistent or exhibited growth during this period. While Shopify's revenue performance has been commendable, the company's net income, cash flow, free cash flow, and gross margin have not shown consistent positive trends over the past five years.

Given that Shopify Inc. is currently unprofitable, with negative ROE and ROIC, it becomes challenging to utilize these ratios as meaningful indicators for capital allocation decisions. In a scenario where a company is not generating profits, traditional metrics like ROE and ROIC lose their significance as they rely on earnings to measure the effectiveness of capital allocation. In such circumstances, alternative approaches or metrics that focus on improving profitability and cash flow generation may be more appropriate to determine how capital should be allocated within the company.

The current ratio, which measures the company's ability to cover short-term obligations, stands at a healthy 6.71, surpassing my requirement of being greater than 1.0 and suggesting sufficient liquidity to meet immediate liabilities. However, the debt-to-EBITA ratio, which assesses a company's leverage, falls short of my requirement of being below 3.0, with a value of -0.68. It's important to note that interest coverage, a measure of a company's ability to meet interest expenses, cannot be evaluated as Shopify is currently unprofitable. Similarly, the debt servicing ratio is not meaningful due to the lack of profitability. While Shopify demonstrates strong liquidity with a favourable current ratio, the unfavourable debt-to-EBITA ratio and the inability to assess interest coverage and debt servicing highlight challenges in terms of leverage and profitability.

Considering Shopify's narrow economic moat, unsatisfactory performance, unprofitability, and negative free cash flow, investing in this company comes with a substantial amount of uncertainty. Given these factors, a high margin of safety of at least 50% is crucial for potential investors. Such a substantial margin of safety would provide a cushion against the inherent risks and uncertainties associated with Shopify's current financial situation and performance, helping to mitigate potential investment losses.

Please help us report any inaccurate information here. Thank you.