Quest Diagnostics Fundamental Analysis

Disclaimer: This article by The Globetrotting Investor is general in nature. We aim to bring you long-term focused analysis driven by fundamental data, hence, providing you commentary based on historical data and analyst forecasts only using an unbiased methodology. This is not a buy/ sell recommendation, and it is solely for educational purposes. Please do your research before investing. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Please read the full disclaimer here.

Quest Diagnostics

Last Updated: 12 Dec 2022

NYSE: DGX

GICS Sector: Healthcare

Sub-Industry: Diagnostics & Research

Table of Contents

Management

CEO: Jim Davis

Tenure: 0.1 year

Quest Diagnostics Incorporated's management team has an average tenure of 3.8 years. It is considered experienced.

Source of Revenue

Quest Diagnostics Incorporated provides diagnostic testing, information, and services in the United States and internationally.

The company is made up of two businesses: Diagnostic Information Services and Diagnostic Solutions.

Diagnostic Information Services

The Diagnostic Information Services business develops and delivers diagnostic information services, providing insights to patients, clinicians, hospitals, independent delivery networks, health plans, employers, direct contract entities, and accountable care organisations through a network of laboratories, patient service centres, phlebotomists in physician offices, call centres and mobile paramedics, nurses, and other health and wellness professionals.

The services primarily are provided under the Quest Diagnostics brand, but the company also provides services under other brands, including AmeriPath,® Dermpath Diagnostics,® ExamOne,® and Quanum.®

Clinical testing is an essential element in the delivery of healthcare services. Clinical testing is used for predisposition, screening, monitoring, diagnosis, prognosis and treatment choices of diseases and other medical conditions. Clinical testing is generally categorised as clinical laboratory testing and anatomic pathology services. Anatomic pathology involves the diagnosis of cancer and other diseases and medical conditions through examination of tissue and cell samples taken from patients.

Quest Diagnostics provides information and insights based on the menu of routine, non-routine and advanced clinical testing and anatomic pathology testing and other diagnostic information services. The company has testing capabilities, including services for the predisposition, diagnosis, treatment and monitoring of cancers and other diseases, and offers advanced tests in many fields, including endocrinology, immunology, neurology and oncology.

Quest Diagnostics is a provider of diagnostic information services for infectious diseases, such as COVID-19, tuberculosis and tickborne disease. The company is also a provider of employer population health services, including biometric screenings, flu shots and related preventative services that leverage clinical data to improve population health outcomes and reduce healthcare spending.

Interestingly, Quest Diagnostics also offers sports teams, including at the professional and collegiate levels, BluePrint for Athletes® performance tools, based on biomarker testing, designed to optimise high-level athletic performance through actionable insights.

Diagnostic Solutions

The Diagnostic Solutions group includes Quest Diagnostics' risk assessment services business, which offers solutions for insurers, and the healthcare information technology business, which offers solutions for healthcare providers.

Quest Diagnostics is the largest provider of risk assessment services to the life insurance industry in North America. The risk assessment services comprise underwriting support services, including data gathering, paramedical examinations and clinical laboratory testing and analytics, designed to assist life insurance companies objectively to evaluate the mortality risks of applicants.

The company’s healthcare information technology business offers healthcare organisations and clinicians robust health information technology solutions. The cloud-based, mobile-accessible offering enables clinicians to generate a complete record of a clinical patient encounter, automates and streamlines the clinician's workflow, provides clinical decision support tools, captures patient encounter notes and lab and radiology results and enables secure communication with patients and other clinicians.

Quest Diagnostics Reportable Segment Revenue

Quest Diagnostics Economic Moat

Quest Diagnostics Economic Moat

Economic Moat: Narrow

There are many ways to identify Quest Diagnostics’s economic moat, but I focus on the above 5 types. The rating is purely subjective and based on my in-depth understanding and analysis of Quest Diagnostics. Please check my summary to understand more about the economic moat.

Performance Checklist

Is Quest Diagnostics’s revenue growing YoY for the past 5 years consistently? Yes.

Is the net income growing YoY for the past 5 years consistently? Yes.

Is the cash flow from operating activities growing YoY for the past 5 years consistently? Yes.

Is the free cash flow positive for the past 5 years? Yes.

Is the gross margin % consistent/ growing for the past 5 years? Inconsistent.

Is the EPS growing for the past 5 years? Yes.

Quest Diagnostics Revenue, Net Income, Operating Cash Flow, and FCF (USD Million)

Is the free cash flow per share growing for the past 5 years? Inconsistent.

Quest Diagnostics FCF per Share

Management Effectiveness

Is Quest Diagnostics’s ROE consistently at 12%-15% YoY for the past 5 years? Yes.

Quest Diagnostics Return on Equity

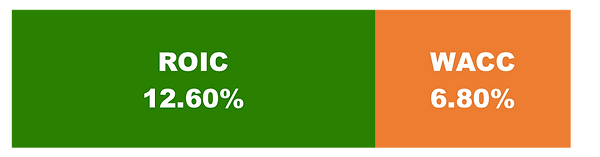

Is the ROIC consistently at 12%-15% YoY for the past 5 years? No.

Quest Diagnostics Return on Invested Capital vs Weighted Average Cost of Capital

The trendline for the number of shares outstanding is increasing, which is something that an investor would not be pleased to see.

Quest Diagnostics Shares Outstanding (Million Shares)

Quest Diagnostics Financial Health

Quest Diagnostics Financial Health (USD Million)

Current Ratio: 1.46 (pass my requirement of >1.0)

Debt-to-EBITA: 2.11 (pass my requirement of <3.0)

Interest Coverage: 12.36 (pass my requirement of >3.0)

Debt Servicing Ratio: 8.04% (pass my requirement of <30.0%)

Dividend

Current Dividend yield: 1.77%

Have the dividend payments been stable for the past 5 years? Yes.

Have the dividend payments been growing for the past 5 years? Yes.

Quest Diagnostics’s dividend payments are reasonably covered by its earnings and its cash flows.

Quest Diagnostics Valuation

Estimated intrinsic value: $181.25

Value is calculated using discounted cash flow method (taking into account their cash and debt) and scenario planning.

Average free cash flow used: $1,400 million

Projected growth rate: 5% - 7%

Beta: 1.09

Discount rate: 7.3%

Date of calculation: 12 Dec 2022

Quest Diagnostics Price-Earnings Ratio vs its peers

Quest Diagnostics Historical Price-Earnings Ratio

Additional Resources

I recommend reading The Little Book of Valuation: How to Value a Company, Pick a Stock and Profit as it greatly helps in my stock analysis. If you want a complete collection of recommended books, please visit here.

Quest Diagnostics Stock Performance

Set forth below is a line graph comparing the cumulative total shareholder return on Quest Diagnostics' common stock since December 31, 2016 based on the market price of the company's common stock and assuming reinvestment of dividends, with the cumulative total shareholder return of companies on the Standard & Poor's (S&P) 500 Stock Index and the S&P 500 Health Care (Sector) Index.

Quest Diagnostics Stock Performance

My Top Concern

The U.S. healthcare system is evolving, and medical laboratory testing market fundamentals are changing, and Quest Diagnostics’ business could be impacted if the company fails to adapt.

For example, value-based reimbursement is increasing (e.g., UnitedHealthcare's Preferred Lab Network); CMS has set goals for value-based reimbursement to be achieved. Patients are encouraged to take an increased interest in and responsibility for, and often are bearing increased responsibility for payment for, their healthcare. Healthcare industry participants are evolving and consolidating. Healthcare services increasingly are being provided by non-traditional providers (e.g., physician assistants), in non-traditional venues (e.g., retail medical clinics, urgent care centres) and using modern technologies (e.g., telemedicine, digital pathology). The utilisation of the healthcare system is influenced by several factors and may result in a decline in the demand for diagnostic information services.

The clinical testing business remains a fragmented and highly competitive industry. Quest Diagnostics primarily competes with three types of clinical testing providers: other commercial clinical laboratories, Independent Delivery Network-affiliated laboratories, and physician-office laboratories. In addition, new players have recently started to provide clinical laboratory testing services (e.g., employers; government agencies).

The diagnostic information services industry also faces changing technology and new product introductions. Competitors may compete using advanced technology, including technology that enables more convenient or cost-effective testing. Competitors may also compete based on new service offerings.

In such a highly competitive landscape, if Quest Diagnostics fails to provide an appropriately priced level of service or otherwise fails to compete effectively it could have a material adverse effect on its revenues and profitability.

Summary for Quest Diagnostics

Quest Diagnostics’ narrow moat rating does not mean that the company does not excel well in creating an economic moat. Rather, the company has a well-balanced source of moat, but none stands out except for its cost advantages.

Quest Diagnostics and its primary national competitor, LabCorp, dominate independent diagnostic testing in the U.S. by building a vast network of laboratories and patient service centres across the country. The industry has also witnessed steady consolidation as both companies have acquired smaller competitors. This inevitability created barriers to entry and generated significant cost advantages over regional and hospital labs.

With an extensive network of laboratories and patient service centres, it presents a challenge for new entrants to replicate from scratch. In addition, Quest Diagnostics’ robust and well-established processes lower the risk of quality and reliability issues. New entrants without a track record may find it difficult to compete in terms of quality and reliability.

Besides barriers of entry that the company has created, Quest Diagnostics generates significant cost advantages due to its scale and volume. The company’s cost structure and national coverage also attract payers that structure reimbursement and policies to funnel patients to the large independent labs that offer lower prices. This is one key trend that the clinical testing industry is observing in the U.S. healthcare system.

Independent Delivery Networks (IDN) including hospitals and hospital health systems, which provide outreach testing and may encourage clinicians to send their outreach testing volume to the IDN's laboratory, historically were able to negotiate higher reimbursement rates with health plans than commercial clinical laboratories for comparable services. In addition, health plans generally reimburse non-participating laboratory testing providers at higher out-of-network rates. Quest Diagnostics is finding increased interest among health plans in driving better value in spending for laboratory testing. Health plans increasingly are taking steps to encourage the movement of testing volume to high-value, lower-cost providers like Quest Diagnostics, including by identifying preferred provider partners, plan design changes (e.g., zero-dollar out-of-pocket costs for members using preferred providers) and better aligning reimbursement rates for IDN-based providers and independent commercial laboratories. The UnitedHealthcare Preferred Lab Network, which chose Quest Diagnostics to participate, is a recent example of a health plan taking these steps.

With cost advantages being the only exceptional source of moat for Quest Diagnostics, I will assign the company a narrow economic moat rating.

Quest Diagnostics’ performance is satisfactory. The company’s revenue, earnings and operating cash flow are increasing year on year for the past 5 years. It also maintains a positive cash flow. However, Quest Diagnostics’ gross margin varies from year to year, and it is below its industry average.

Quest Diagnostics meets my requirements for ROE but not ROIC. The company achieves more than 12% ROE consistently over the past 5 years and is above its industry average. However, its ROIC has been hovering around 9% - 10% over the past 5 years. Despite a low percentage point, Quest Diagnostics ROIC is still two times more than its WACC.

Quest Diagnostics meets all my requirements for a good balance sheet. Its current ratio and debt-to-EBITA are satisfactory but still perform below its industry averages. Although Quest Diagnostics’ debt-to-equity ratio has reduced over the past 5 years, it is still considered high.

With a narrow economic moat, decent performance, and financial health, I will assign a 40% margin of safety. So, with an estimated intrinsic value of $181.25, I will only purchase the stock if the price is trading around the $110 range.

Please help us report any inaccurate information here. Thank you.