Alliant Energy Corporation Fundamental Analysis

Disclaimer: This article by The Globetrotting Investor is general in nature. We aim to bring you long-term focused analysis driven by fundamental data, hence, providing you commentary based on historical data and analyst forecasts only using an unbiased methodology. This is not a buy/ sell recommendation, and it is solely for educational purposes. Please do your research before investing. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Please read the full disclaimer here.

Alliant Energy Corporation

Last Updated: 27 Mar 2023

NASDAQ: LNT

GICS Sector: Utilities

Sub-Industry: Utilities — Regulated Electric

Table of Contents

You can download a summary of Alliant Energy Corporation's fundamental analysis in PDF here.

Management

CEO: John Larsen

Tenure: 4.1yrs

Alliant Energy Corporation's management team has an average tenure of 4.2 years. It is considered experienced.

Source of Revenue

Alliant Energy’s primary focus is to provide regulated electric and natural gas service to customers in the Midwest through its two public utility subsidiaries, Interstate Power & Light Company, and Wisconsin Power & Light Company.

Interstate Power & Light Company (IPL) is a public utility engaged principally in the generation and distribution of electricity and the distribution and transportation of natural gas to retail customers in select markets in Iowa. The company provides utility services to incorporated communities as directed by the Iowa Utilities Board and utilises non-exclusive franchises, which cover the use of public rights-of-way for utility facilities in incorporated communities for a maximum term of 25 years.

Wisconsin Power & Light Company (WPL) is a public utility engaged principally in the generation and distribution of electricity and the distribution and transportation of natural gas to retail customers in select markets in Wisconsin. WPL operates in municipalities pursuant to permits of indefinite duration and state statutes authorising utility operation in areas annexed by a municipality.

Alliant Energy’s non-utility holdings are organised under Alliant Energy Finance, which manages a portfolio of wholly-owned subsidiaries and additional holdings. This includes:

-

AE Transco Investments holds all of Alliant Energy’s interests in American Transmission Company Holdings.

-

Corporate Venture Investments - includes various minority ownership interests in regional and national venture funds, including a global coalition of energy companies working together to help advance the transition towards a cleaner, more sustainable, and inclusive energy future.

-

Non-utility Wind Farm

-

Sheboygan Falls Energy Facility

-

Travero, is a diversified supply chain solutions company, including a short-line rail freight service in Iowa; a Mississippi River barge, rail, and truck freight terminal in Illinois; freight brokerage services; and a rail-served warehouse in Iowa.

Alliant Energy’s utility business (IPL and WPL) has three segments: 1) electric operations, 2) gas operations, and 3) other, which includes IPL’s steam operations and the unallocated portions of the utility business.

Electric Utility Operations

Electric utility operations represent the largest operating segment for Alliant Energy with IPL providing retail electric service in Iowa and WPL providing retail and wholesale electric service in Wisconsin. IPL also sells electricity to wholesale customers in Minnesota, Illinois, and Iowa.

IPL and WPL provide electric utility service to a diversified base of retail customers in several industries, with the largest concentrations in the farming, agriculture, industrial manufacturing, chemical, packaging and food industries. IPL and WPL also sell electricity to wholesale customers, which primarily consist of municipalities and rural electric cooperatives.

Electric sales are seasonal to some extent with the annual peak normally occurring in the summer months due to air conditioning requirements. Electric sales are also impacted to a certain extent in the winter months due to heating requirements.

Gas Utility Operations

Gas utility operations represent the second-largest operating segment for Alliant Energy, with IPL providing gas service in Iowa and WPL providing gas service in Wisconsin.

IPL and WPL provide gas utility services to a diversified base of retail customers and industries, including research, education, hospitality, manufacturing, and chemicals (including ethanol). In addition, IPL and WPL provide transportation services to commercial and industrial customers by moving customer-owned gas through Alliant Energy’s distribution systems to the customers’ meters.

Gas sales follow a seasonal pattern with an annual base load of gas and a large heating peak occurring during the winter season. Natural gas obtained from producers, marketers and brokers, as well as gas in storage, is utilised to meet the peak heating season requirements. Storage contracts generally allow IPL and WPL to purchase gas in the summer and inject it into underground storage fields, and remove it from storage fields in the winter to deliver to customers.

Other Utility Operations – Steam

IPL’s Prairie Creek facility is the primary source of steam for IPL’s two high-pressure steam customers in Iowa. These customers are each under contract through 2025 for taking minimum quantities of annual steam usage, with certain conditions.

Alliant Energy Corporation Reportable Segment Revenue FY2022

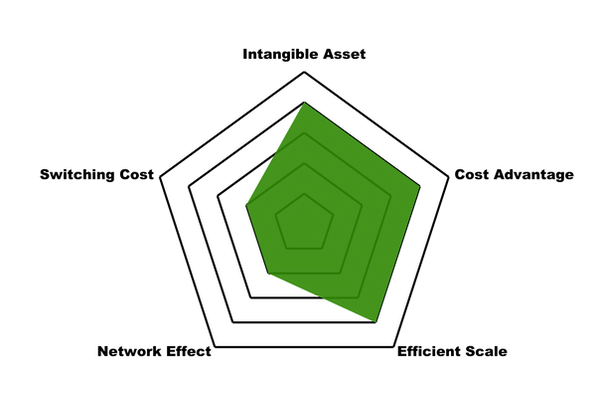

Alliant Energy Corporation Economic Moat

Alliant Energy Corporation Economic Moat

Economic Moat: Narrow

There are many ways to identify Alliant Energy Corporation’s economic moat, but I focus on the above 5 types. The rating is purely subjective and based on my in-depth understanding and analysis of Alliant Energy Corporation. Please check my summary to understand more about the economic moat.

Performance Checklist

Is Alliant Energy Corporation’s revenue growing YoY for the past 5 years consistently? Inconsistent.

Is the net income growing YoY for the past 5 years consistently? Yes.

Is the cash flow from operating activities growing YoY for the past 5 years consistently? Inconsistent.

Is the free cash flow positive for the past 5 years? Yes.

Is the gross margin % consistent/ growing for the past 5 years? Yes.

Is the EPS growing for the past 5 years? Yes.

Alliant Energy Corporation Revenue, Net Income, Operating Cash Flow, and FCF (USD Million)

Is the free cash flow per share growing for the past 5 years? No.

Alliant Energy Corporation FCF per Share

Management Effectiveness

Is Alliant Energy Corporation’s ROE consistently at 12%-15% YoY for the past 5 years? No.

Alliant Energy Corporation Return on Equity

Is the ROIC consistently at 12%-15% YoY for the past 5 years? No.

Alliant Energy Corporation Return on Invested Capital vs Weighted Average Cost of Capital

The trendline for the number of shares outstanding is increasing, which is something that an investor would not be pleased to see.

Alliant Energy Corporation Shares Outstanding (Million Shares)

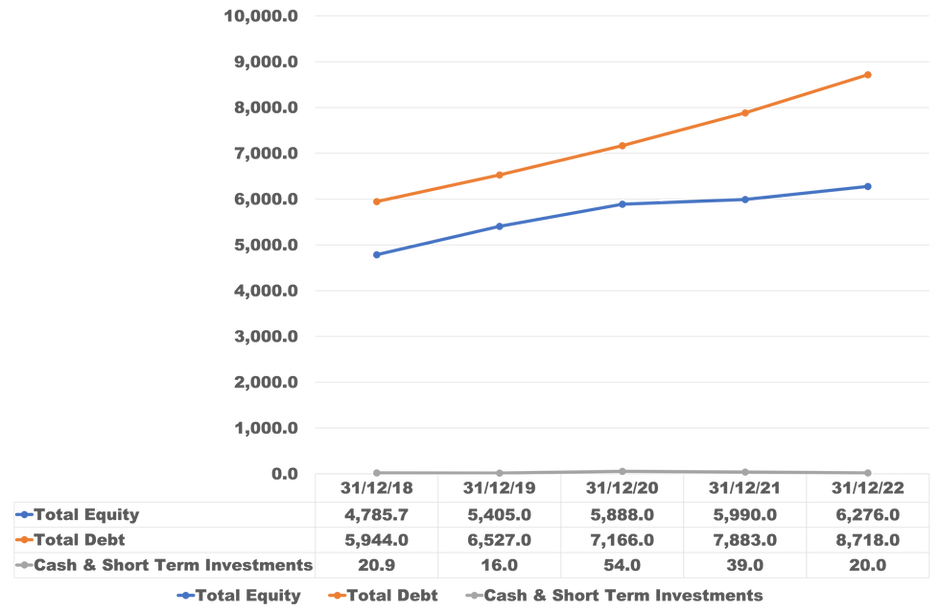

Alliant Energy Corporation Financial Health

Alliant Energy Corporation Financial Health (USD Million)

Current Ratio: 0.5 (fail my requirement of >1.0)

Debt-to-EBITA: 5.1 (fail my requirement of <3.0)

Interest Coverage: 2.9 (fail my requirement of >3.0)

Debt Servicing Ratio: 66.9% (fail my requirement of <30.0%)

Dividend

Current Dividend yield: 3.5%

Have the dividend payments been stable for the past 5 years? Yes.

Have the dividend payments been growing for the past 5 years? Yes.

Alliant Energy Corporation’s dividend payments are reasonably covered by its earnings and its cash flows.

Alliant Energy Corporation Valuation

Estimated intrinsic value: $15.39

Value is calculated using discounted cash flow method (taking into account their cash and debt) and scenario planning.

Average free cash flow used: USD$550M

Projected growth rate: 6% - 7%

Beta: 0.56

Discount rate: 5.0%

Date of calculation: 27 Mar 2023

Free cash flow used is a weighted average that is rounded to the nearest tens. In some instances, I used a more realistic number to represent the free cash flow.

Total debt and cash and short-term investments are last quarter figures that are rounded to the nearest tens. In some instances, I used more realistic numbers to represent them.

Alliant Energy Corporation EV-to-EBITA vs its peers

Alliant Energy Corporation Price-Earnings Ratio vs its peers

Alliant Energy Corporation Historical Price-Earnings Ratio

Additional Resources

I recommend reading University of Berkshire Hathaway as it greatly helps in my stock analysis. If you want a complete collection of recommended books, please visit here.

My Top Concern

My first concern is the risk involving Alliant Energy’s large construction projects. Part of Alliant Energy's strategy involves constructing renewable generating facilities and upgrading its electric and gas distribution systems, but these construction projects are subject to various risks, such as delays due to construction accidents, or changes in regulations or costs. There is also the risk of not being able to recover all project costs and facing a potential impairment of project investment. If a construction project is not completed or delayed, it could negatively impact the company's financial condition.

But my biggest concern is that Alliant Energy operates in a highly regulated business environment and there are significant risks related to laws and regulations.

The financial condition of the utility is heavily influenced by regulatory authorities and their establishment of rates, authorised rates of return, and costs that can be recovered from customers. Alliant Energy’s ability to timely obtain rate adjustments depends upon timely regulatory action. Additionally, operations are subject to extensive regulation by various organisations, including the North American Electric Reliability Corporation and the Transportation Security Administration, and failure to obtain approvals for certain matters promptly may affect business operations.

Alliant Energy is also subject to various federal, regional, state, and local environmental laws, regulations, and court orders, which involve emissions into the air, water discharges, use of water, waste disposal, and more. Failure to comply with these laws and regulations could result in injunctions, fines, or other sanctions. These laws and regulations may impose additional costs on Alliant Energy and may force them to incur significant expenses in the future, which may impact its financial condition.

Summary for Alliant Energy Corporation

Utility companies typically have a few sources of economic moat that help them maintain a competitive advantage in the market, and for Alliant Energy, it will be its intangible assets and cost advantages.

Alliant Energy’s intangible assets stem from the regulations and the relationship between the company and state and federal regulators. Regulated utilities are often given permission by state and federal regulators to have exclusive rights to charge customers rates that enable them to earn a reasonable profit on the capital they invest to construct, manage, and maintain their distribution systems.

In return for being granted a monopoly within their service territory, the regulators set returns at levels that aim to minimise customer expenses while providing fair returns for the company. Alliant Energy meets the regulatory requirements and appears to have positive relationships with regulators in Iowa and Wisconsin.

Such regulation can also create barriers to entry for competitors. Regulations may require significant capital investments to meet safety, environmental, and service quality standards. This can make it difficult for new companies to enter the market, as they may not have the resources to comply with regulations.

Utility companies often have significant physical infrastructures, such as power plants, transmission lines, and pipelines, which can be expensive to replicate. This infrastructure is critical to delivering essential services, such as electricity, gas, and water, to customers. To strengthen its position within the markets, IPL is expanding its renewable energy portfolio in Iowa with plans to install significant solar generation and distributed energy resources, alongside its existing wind generation. Meanwhile, WPL focuses on renewable energy as the company replaces retiring coal generation. WPL plans to invest in sizable solar energy with battery storage and eliminates coal from its generation fleet. The company aims to achieve net-zero carbon dioxide emissions by 2050 as part of its Clean Energy Blueprint.

Alliant Energy can benefit from economies of scale as they grow its customer base. This can help lower their operating costs and improve profitability. The company is also able to negotiate better rates for fuel or equipment purchases, which can reduce costs.

Although the intangible assets and cost advantages as sources of economic moat, there is still a risk relating to the regulation (see my top concerns). Even though the level of threat is low, I am only comfortable assigning Alliant Energy a narrow economic moat.

The company's performance over the past 5 years has been marked by some notable trends. First, Alliant Energy's revenue has been inconsistent over the past 5 years. It experienced a dip during the pandemic years, which impacted many businesses across industries, but has since rebounded.

Second, Alliant Energy's operating cash flow has not been consistent over the past 5 years. This may be due to the company's ongoing investment in infrastructure and large construction projects. Third, Alliant Energy's net income has been growing year over year over the past 5 years. This suggests that the company has been successful in managing its costs despite the challenges presented by the pandemic and other factors.

Finally, Alliant Energy's gross and net margins have been growing year on year and are consistently above its industry average over the past 5 years. This may reinforce the fact that the company has a strong focus on efficiency and cost control.

While neither of Alliant Energy’s ROE and ROIC met my minimum requirement of 12%, the company’s capital allocation over the past 5 years has been relatively consistent, with both remaining within the range of the industry average. Alliant Energy's ROE was about 3% higher than the industry average and the company's ROIC was slightly above its WACC.

The financial health of Alliant Energy appears to be a cause for concern. The balance sheet has failed all four of my debt requirements, indicating that the company may be taking on too much debt. The current ratio is worse than its historical past and industry average, suggesting that the company may have difficulty meeting its short-term obligations. As evidence, the company’s short-term assets are not sufficient to cover its short-term liabilities, which may result in liquidity issues.

The debt to EBITA and net debt to equity ratio have increased over the past 5 years to a level that is considered high, indicating that the company may be relying too heavily on debt to finance its operations. Finally, interest payments are not well covered by EBIT and operating cash flow, which may further exacerbate the company's debt issues.

The overall outlook for Alliant Energy is uncertain due to its narrow moat, inadequate performance, capital allocation, and weak balance sheet. Given the high level of uncertainty, a margin of safety of 50% would be appropriate for investors. Hence, based on the company's estimated intrinsic value of $15.39, the margin of safety would bring the purchase price down to the range of $8 per share.

Please help us report any inaccurate information here. Thank you.